The Thrill of the Find: Discovering Unique Pieces on Resale Sites

The Excitement of Unexpected Discoveries

Secondhand marketplaces aren't merely digital dumping grounds for unwanted possessions - they're veritable goldmines of forgotten artifacts waiting for curious explorers. Picture this: you're browsing casually when you encounter a 1960s turntable with a matching set of fragile shellac discs, or perhaps a first-edition novel containing margin notes from its original owner. These serendipitous encounters form the very essence of what makes thrifting online so exhilarating. The dopamine rush from uncovering something extraordinary frequently outweighs the actual monetary value, creating a shopping experience that conventional retailers simply can't replicate.

The staggering diversity of available goods defies imagination. High-end fashion pieces sit alongside retro gaming consoles, while mid-century modern chairs neighbor rare comic books. This overwhelming selection cultivates a perpetual sense of adventure, turning every search into a potential treasure hunt. There's always the possibility of chancing upon a fascinating historical artifact or overlooked masterpiece that could become the centerpiece of your collection.

Smart Shopping and Financial Benefits

For savvy consumers, the real magic of these platforms lies in their unparalleled cost efficiency. Premium-quality goods often appear at fractions of their original retail prices, enabling budget-conscious shoppers to acquire distinctive items that would normally be financially inaccessible. This proves especially valuable for collectors building curated assemblages without draining their savings accounts.

The interactive nature of price negotiations injects additional adrenaline into the process. This give-and-take dynamic, where you might land an incredible bargain through skillful haggling, intensifies the overall excitement. These platforms don't just offer economic advantages - they provide an entertaining shopping experience where every interaction could lead to a major score. Beyond the personal benefits, this approach naturally supports environmentally responsible consumption patterns.

Environmental Impact and Conscious Consumption

The significance of resale platforms extends beyond personal savings - they represent an important stride toward sustainable living. By breathing new life into pre-owned items, participants actively contribute to reducing manufacturing demand and keeping usable goods out of landfills. This eco-conscious decision reflects growing societal awareness about excessive consumption's ecological footprint, adding ethical satisfaction to every purchase. It's a perfect scenario where personal financial benefits align with planetary wellbeing.

Building Connections Through Shared Passions

Perhaps less obvious but equally valuable is the thriving social ecosystem these platforms cultivate. Enthusiasts exchange stories, offer recommendations, and share specialized knowledge, creating meaningful bonds between like-minded individuals. This communal aspect transforms solitary browsing into a shared adventure, enhancing enjoyment for both veteran collectors and newcomers. The collective excitement surrounding unique discoveries adds depth to every transaction while fostering supportive networks of passionate individuals.

Mastering the Hunt: Expert Techniques for Finding Rare Items

Discovering Undervalued Niches

In the sprawling marketplace of financial opportunities, the most lucrative prospects often lurk in specialized sectors. Instead of battling crowds in oversaturated markets, discerning investors should target niche segments. These specialized areas frequently contain undervalued assets with less competition and greater potential returns. Meticulous investigation into developing trends and overlooked demographics can expose these golden opportunities, enabling strategic positioning before the masses catch on.

Developing Valuable Partnerships

Successful navigation of financial markets often depends on cultivating strong professional networks. Nurturing relationships with suppliers and distributors can unlock access to exclusive offerings, favorable terms, and critical industry intelligence. Establishing trust and maintaining transparent communication channels prove indispensable when maneuvering through the financial sector's complexities. This proactive networking strategy can create substantial competitive edges that translate to tangible results.

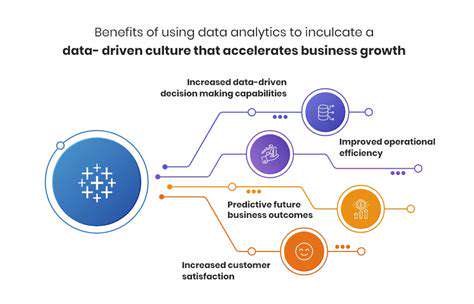

Comprehensive Market Evaluation

In-depth market analysis serves as the foundation for identifying patterns and forecasting future movements. Examining historical performance metrics, competitor behavior, and technological advancements provides clearer market understanding. Investors should synthesize information from diverse sources - including sector reports, analytical studies, and digital trend data - to construct a multidimensional perspective of current conditions and probable developments. This rigorous analytical approach enables data-driven strategies with higher success probabilities.

Embracing Change and Innovation

Financial markets experience constant transformation as new technologies and methodologies emerge. Maintaining adaptability and progressive thinking becomes crucial for sustained success. Keeping abreast of industry innovations and adjusting tactics accordingly can dramatically improve market positioning. This requires openness to technological adoption, exploration of developing sectors, and continuous reassessment of existing approaches to ensure alignment with evolving market realities.

Implementing Risk Mitigation Strategies

Like all investment environments, financial markets carry inherent uncertainties. Developing comprehensive risk management protocols is essential for minimizing potential downsides and protecting assets. Portfolio diversification, thorough vetting processes, and alternative scenario planning all contribute to robust risk frameworks. Recognizing possible hazards and establishing preventative measures helps navigate market volatility while safeguarding against unexpected challenges.

The Virtue of Strategic Patience

Financial markets often reward measured, long-term perspectives. Impulsive decisions or rushed investments frequently lead to disappointing outcomes. Formulating clear extended horizons, establishing achievable milestones, and maintaining strategic discipline form the cornerstone of successful market participation. This patient methodology allows investors to endure market fluctuations, capitalize on gradual trends, and ultimately realize sustainable growth - an essential mindset for navigating financial markets' unpredictable nature.